Automotive Steering System Market Growth Factors, Opportunities, Ongoing Trends and Key Players 2025

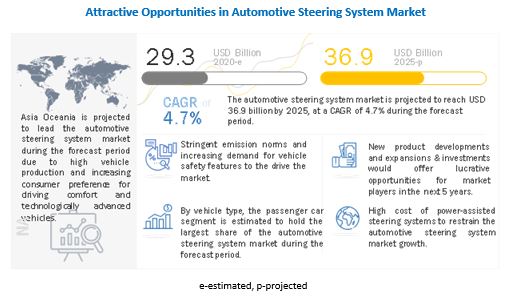

The global Automotive Steering System Market is projected to reach a value of USD 36.9 billion by 2025 from USD 29.3 billion in 2020, growing at a CAGR of 4.7%. The growth of this market is primarily driven by the increasing demand for fuel-efficient and better-driving comfort vehicles.

Automotive Steering System Market Dynamics

Driver: Stringent fuel efficiency norms to drive demand for electrically assisted steering systems

Several governments across the globe have introduced stringent emission and fuel economy regulations for vehicles. Regulatory bodies such as the National Highway Traffic and Safety Administration (NHTSA) in the US, the International Council on Clean Transportation (ICCT) in Europe, and other associations have implemented fleet-level regulations. These regulations indicate an average emission limit that needs to be maintained by automotive OEMs. These regulations have compelled automotive OEMs to increase their fuel-efficient steering technologies such as electric power steering. Electrically assisted power steering systems are lighter in weight and are less complex in structure compared to traditional hydraulic steering systems. Moreover, as there are no fuels involved, they are also easier for car owners to maintain. As per the US Department of Energy (DOE), in ideal conditions, EPS systems can increase fuel efficiency by 2% to 4%, reduce fuel consumption by up to 6%, and decrease CO2 emissions by 8g/km. Estimations show that EPS systems have helped save almost 3 billion gallons of gas since 1999 (Source: Nexteer Automotive). These systems use power only when the wheels are turned, unlike hydraulic systems that pump fluid all the time while the engine is running. This directly results in increased fuel economy. The penetration of electrically assisted power steering is highest in the European region, followed by North America and Asia Oceania respectively.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=940

Opportunities: Use of EPS systems in commercial vehicles

EPS is currently used in passenger vehicles and light commercial vehicles and has a limited presence in heavy vehicles. With advancements in technology, EPS systems could have a better load-bearing capacity and be used in commercial vehicles as well. Presently, HPS systems dominate the commercial vehicle segment owing to their higher load-bearing capacity than EPS systems. HPS systems draw power from the engine, decreasing fuel efficiency.

The EPS system draws power from the battery and is, hence, fuel-efficient and more reliable than HPS systems. An increase in load-bearing capacity would ensure the use of this technology in commercial vehicles as well. For instance, Volvo has developed Volvo Dynamic Steering, which is powered by an electric motor. The motor controls the steering 2,000 times per second. This technology has been developed on a ‘Torque Overlay’ platform. Nexteer Automotive has also developed a rack-assisted electric power steering for the pickup truck market. Another leading steering system manufacturer Robert Bosch has introduced Servotwin electro-hydraulic steering system for heavy commercial vehicles. Such developments are expected to create lucrative opportunities for EPS systems in the commercial vehicle segment in the coming years.

Steering Column to be the largest segment, by component.

The steering column segment, by value, is estimated to lead the market as steering columns are installed in all types of steering systems, such as HPS, EHPS, and EPS. Steering columns have incorporated collapsible components to enhance driver safety. These columns crumble or slide together during the impact of a collision, with the columns shortening and absorbing the force. The growth of the steering column segment can be attributed to its high installation rate and its ability to enhance safety. The steering wheel speed sensor segment is expected to register the highest growth rate owing to the increasing adoption of electronics in automobiles and technological advancements in sensor technology.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=940

EPS to be the fastest-growing segment for the automotive steering system market, by technology.

EPS is the largest and fastest-growing segment as it offers various advantages, such as increased fuel efficiency, compact size, and reduction in the overall weight of the vehicles and front axle loads. EPS, majorly adopted in passenger cars, is increasingly adopted in light commercial vehicles as well. But it is still not used actively in heavy commercial vehicles as it is not designed for high axle loads and high steering rack force.

Key Market Players:

The automotive steering system market is led by globally established players such as Nexteer Automotive Group Limited (US), JTEKT Corporation (Japan), Hyundai Mobis Co., Ltd. (South Korea), Showa Corporation (Japan), NSK Ltd. (Japan), and Robert Bosch GmbH (Germany). These companies adopted several strategies to gain traction in the growing automotive steering system market

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=940

Media Contact

Company Name: Marketsandmarkets pvt ltd

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: India

Website: https://www.marketsandmarkets.com/Market-Reports/automobile-steering-systems-market-940.html